Status of Corporate Governance

Basic Concept of Corporate Governance

The PARK24 GROUP (hereinafter called “the GROUP”) strives to make sustainable improvements in its corporate value under the GROUP’s philosophy of creating new forms of comfort and convenience by responding to the needs of today and anticipating the needs of tomorrow.

Essential factors for the sustainable enhancement of corporate value include the establishment of trusting relationships with all stakeholders, not to mention the expansion of businesses. From this perspective, the GROUP seeks to strengthen and enhance the level of corporate governance by continuing to improve the fairness, transparency and objectivity of management.

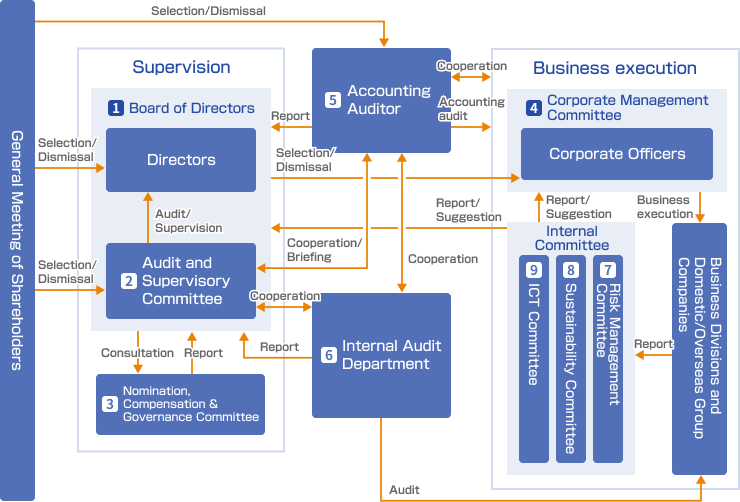

Corporate Governance Structure

(as of July 15, 2025)

Overview of the Corporate Governance System and Reasons for its Adoption

(as of November 1, 2024)

The GROUP has an Audit and Supervisory Committee governance structure and seeks to continually increase its corporate value by ensuring management transparency and fairness, and strengthening the supervisory functions. The GROUP also adopts the Corporate Officer system, separating the supervisory functions (Directors) and the business execution functions (Corporate Officers), with the intention of accelerating decision-making.

The GROUP has established a Nomination, Compensation & Governance Committee as an optional advisory body to ensure fairness, transparency and objectivity in the procedures for the nomination and compensation of the Directors and enhance corporate governance. In addition, the "Sustainability Committee" has been established to carry out stronger group-wide sustainability initiatives to resolve environmental and social issues.

1. Board of Directors

The GROUP believes that the important roles and responsibilities of the Board of Directors are to determine the direction of strategies, allocate management resources, and audit and supervise business execution by the Corporate Officers. The Board of Directors discusses and formulates the GROUP’s annual plan, medium-term management plan, management strategies, and management plans, and strives to strengthen the monitoring of business execution. Through this, the GROUP aims to continuously enhance corporate value in the medium and long terms to benefit all stakeholders.

To enable sufficient discussions and accelerate decision-making, the Articles of Incorporation stipulate that the GROUP shall have no more than ten (10) Directors, excluding Directors who are Audit and Supervisory Committee Members, and no more than five (5) Directors who are Audit and Supervisory Committee Members. The GROUP appoints individuals who understand and can implement the GROUP philosophy, have a good personality and extensive knowledge, and can fulfill their responsibilities as Directors.

The Nomination, Compensation & Governance Committee, a committee consisting of the Representative Director and Outside Directors and chaired by an Outside Director, has been established to increase fairness, transparency, and objectivity in the decision-making process at the Board of Directors and enhance the corporate governance system. This committee discusses the appointment of Directors proposed by the Board of Directors and submits recommendations. The Board of Directors, which includes Outside Directors, decides on the agenda item about the appointment of Directors based on the recommendations of the committee.

2. Audit and Supervisory Committee

The Audit and Supervisory Committee audits compliance with laws and regulations, the Articles of Incorporation, and internal rules and regulations by the Directors, Corporate Officers, or employees at the Company and GROUP companies. The Audit and Supervisory Committee consists of three (3) Directors who are members of the Audit and Supervisory Committee, the majority of whom are Outside Directors. Each Audit Committee member has abundant knowledge and experience in accounting, finance, auditing, and compliance, extensive insight and experience mainly in the field of corporate legal affairs, including overseas, specialized knowledge and extensive experience in accounting audits, as well as experience in auditing the Company's business. They actively and positively express appropriate opinions to the Board of Directors and management from an independent and objective standpoint. In addition, the GROUP has appointed a full-time Audit and Supervisory Committee member to enhance the effectiveness of the Board by combining the objective and highly knowledgeable views of the Outside Directors with the information-gathering capabilities of the full-time Director who serves as an Audit and Supervisory Committee Member.

3. Nomination, Compensation and Governance Committee

The Nomination and Compensation Committee was established in June 2019 to ensure appropriate opportunities for outside directors to be involved in and provide advice on decisions related to director nominations and compensation, to improve the fairness, transparency, and objectivity of the decision-making process at the Board of Directors, and to further enhance the corporate governance system. In November 2023, the Committee was renamed the "Nomination, Compensation & Governance Committee" in addition to expanding its functions.

The Nomination, Compensation & Governance Committee is responsible for (1) matters relating to the election and dismissal of directors, (2) matters relating to policies for determining directors' compensation and other compensation, (3) matters relating to succession planning, (4) matters relating to ensuring the effectiveness of the Board of Directors, (5) matters relating to fiduciary responsibility and accountability to shareholders, and (6) other matters based on consultations from the Board of Directors. The Board of Directors shall deliberate on and report to the Board of Directors on matters concerning corporate governance for which the Board of Directors is consulted.

The members of the Nominating, Compensation & Governance Committee shall consist of representative directors and outside directors, and the chairperson of the committee shall be selected from the outside directors.

4. Executive Committee

Based on the belief that thorough discussions and agile decision-making by people who are conversant with the Company’s business are necessary to achieve the GROUP philosophy, the GROUP has established the Executive Committee consisting of the President and Corporate Officers. The Executive Committee is chaired by the President. At the request of the President, the committee discusses important matters about management, prepares plans, conducts research, makes decisions, and determines the results of those activities. The committee then reports to the President. The process of holding thorough discussions and deliberations as well as decision-making in the Executive Committee is important for the training of successors to top management.

5. Accounting Auditor

The Accounting Auditor takes responsibility for shareholders and investors for proper audits and cooperates with the Audit and Supervisory Committee, the Accounting Department and other relevant departments to take appropriate actions to ensure that audits are conducted properly, including ensuring appropriate audit schedules and systems.

The Accounting Auditor, the Audit and Supervisory Committee and the Internal Audit Department hold meetings regularly to ensure sufficient cooperation.

6. Internal Auditing Department

Internal audits of the Company and the Group are conducted by the Internal Auditing Department in cooperation with the accounting auditor.

7. Risk Management Committee

As a company-wide risk management system, the Risk Management Committee consists of the President and Representative Director and other officers and employees, with the President and Representative Director serving as the chief risk management officer. The Risk Management Committee prepares a risk map listing risks that may affect the Group's management, including risks related to sustainability, including climate change-related issues, and monitors important risks, periodically adding or changing specific risks, evaluating them, and reviewing their prioritization. The results are reported to the Board of Directors once every three months to address and prevent such risks. When risks materialize, the Company plays an important role in ensuring the stable continuation of business and increasing corporate value by minimizing the impact of such risks.

8. Sustainability Committee

The Sustainability Committee promotes cross-group initiatives by formulating sustainability policies and strategies and setting target indicators. The Sustainability Committee is chaired by a director and it consists of executives and employees of the GROUP companies.

Sustainability Promotion Structure

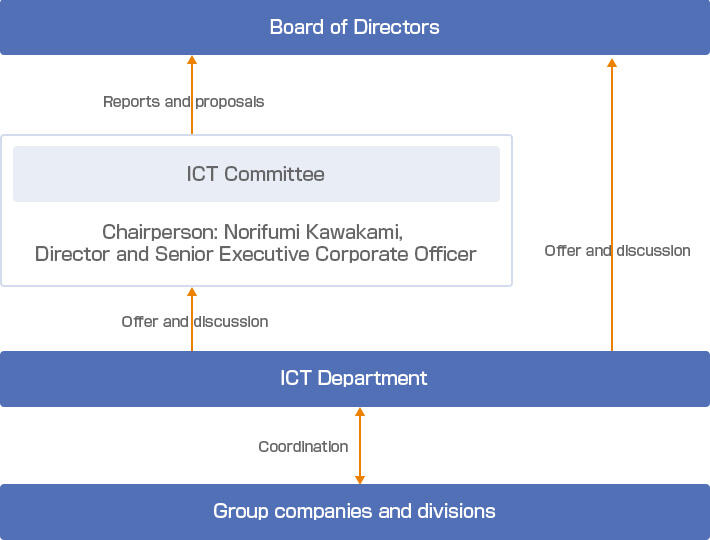

9. ICT Committee

To strongly promote the 2030 theme of "expanding and seamlessly connecting the four networks: people (members), cars (mobility), communities (destinations), and parking facilities," as outlined in the Medium-term Management Plan, the ICT Committee will make flexible investment decisions in line with business strategies to strengthen Group IT governance. The ICT Committee is chaired by a director, and its members consist of executives and employees of the GROUP companies.

Reasons for the Adoption of the System

To achieve the GROUP philosophy, we recognize the importance of establishing a robust governance system that can respond to the expectations of shareholders and other stakeholders, while maintaining a corporate culture that continues to take on challenges and a system that enables swift decision-making. From this perspective, we have separated management supervision from business execution.

For management supervision, we aim to enhance "transparency and objectivity" by centering on Outside Directors in the Board of Directors, and we have adopted a company structure with an Audit and Supervisory Committee to strengthen the audit and supervisory functions by Audit and Supervisory Committee Members who have voting rights in the Board of Directors. For business execution, we have established the Executive Committee to enable swift and rational decision-making.

Appointment criteria for Directors

Directors

We believe that constituting the Board of Directors with individuals who are most familiar with our business is the most effective way to make agile and rational management decisions. Therefore, when appointing members, we deliberate on whether the candidates understand and can implement the GROUP philosophy, possess excellent character and insight, and can fulfill their responsibilities. We then make the final policy decisions accordingly.

Outside Directors

One of the roles considered most important for the position of outside directors is to provide advice and supervision to support effective, executive decision-making from the viewpoint of medium- to long-term growth of our corporate value. For this reason, we appoint outside directors who are considered, based on an overall assessment, to be capable of providing sound advice and opinions on corporate management from a broad perspective using wide-ranging corporate management experience, expert knowledge, or other attributes, and who also have no potential conflict of interest with general shareholders. To perform their advisory and supervisory roles effectively, we believe that it is important for outside directors to be independent of the executive organization. We have therefore established independence standards and ensure that these standards are met by the outside directors.

Criteria for Independence of Outside Directors

The Company has appointed two Outside Directors (excluding Directors who are Audit and Supervisory Committee Members) to strengthen the supervisory functions of the Board of Directors and to ensure highly transparent management. The Company has also appointed two Outside Directors who are Audit and Supervisory Committee Members, to strengthen the corporate governance system and to enhance the audit system. The Company’s basic policy when appointing Independent Directors is to adhere to the standards for independence set forth by the Tokyo Stock Exchange. It has also established its own standards as more specific standards for judging materiality, and elects candidates only if it judges that there is no possibility of a conflict of interest arising between the candidate and general shareholders. The two Outside Directors (excluding Audit and Supervisory Committee Members) and the two Outside Directors who are Audit and Supervisory Committee Members are registered as independent directors with the Tokyo Stock Exchange.

Reasons for appointing Directors

The reasons for the appointment of each person are as follows (as of January 30, 2025).

Koichi Nishikawa [President and Representative Director]

Since joining PARK24 CO., LTD., Mr. Koichi Nishikawa has been working in our parking business, and after gaining experience as a general manager and director in sales and information systems, he assumed the office of President and Representative Director in 2004. He has extensive business experiences in our parking and the mobility business, as well as knowledge of corporate management in general.

Kenichi Sasaki [Director, Senior Executive Corporate Officer]

Since joining PARK24 CO., LTD., Mr. Kenichi Sasaki has been engaged in the parking business and has served as president of a parking facility maintenance company and a contact center company. He has also been in charge of corporate planning for many years, promoting business domain expansion, investor relations, and strategy and vision development. He has also been in charge of human resources and business administration, and served as chairman of the Sustainability Committee, and is familiar with the management of the entire group in Japan and overseas, and has insight into corporate management and administration in general.

Norifumi Kawakami [Director, Senior Executive Corporate Officer]

Since joining PARK24 CO., LTD., Mr. Norifumi Kawakami has served as the general manager of information systems of the Group, making use of his experience working at system companies and consulting companies to promote the use of information technology in our parking and the mobility business, the building of operating systems and the improvement of business efficiency, and has dedicated himself to the growth of the Mobility Business, particularly Times CAR. He has knowledge of corporate management and information systems in general.

Takao Miki [Director, Senior Corporate Officer]

Since joining PARK24 CO., LTD., Mr. Takao Miki has been engaged in the launch and expansion of the parking business and the transformation of its profit structure as the Business Manager of Singapore and Malaysia, which joined our Group in 2017, based on his accounting and finance skills and extensive overseas business experience. In addition, as a corporate planning officer, he has been promoting the planning and implementation of capital policies, financial accounting, and the launch of new businesses amidst the uncertain outlook caused by the new coronavirus disaster. He has insight into global business, accounting, and finance.

Keisuke Kawasaki [Director, Senior Corporate Officer]

Since joining PARK24 CO., LTD., Mr. Keisuke Kawasaki has built on his human resources and legal skills, and has used his work experience in new business development and planning and management to serve as the head of the business development division, president of the operating company when the Company Group entered the mobility business in 2009, and in human resources and business management for the entire Group. In addition, as the person in charge of legal affairs and compliance, he promotes legal and intellectual property management and legal compliance for the entire group, and is also involved in the management of the group's affiliated companies. He has insight into corporate management and legal and compliance matters in general.

Yoshimitsu Oura [Outside Director]

Mr. Yoshimitsu Oura has experience in management as a corporate officer of a listed company and has also served as an outside director of other companies. He will be able to make decisions and provide supervision based on his extensive knowledge and experience. In addition, as chairman of the Nomination, Compensation & Governance Committee, he has played a valuable role in the nomination of directors and contributed to deliberations on the fairness, transparency, and objectivity of directors' compensations.

Shoko Kuroki [Outside Director]

Ms. Shoko Kuroki has deep insight into accounting and finance based on her work experience at foreign consulting firms and major IT companies, as well as in the area of human resources. He contributes to the enhancement of our corporate value by making decisions and supervising our management from a global perspective.

Shingo Yamanaka [Director, Audit and Supervisory Committee Member]

Since joining PARK24 CO., LTD., Mr. Shingo Yamanaka has been engaged in the development and sales of parking facilities, contributing to the growth and development of the parking business, and as a director of the Company, he has been in charge of risk management, internal auditing, and compliance for the entire group. He has also promoted risk management, internal audits, and legal compliance throughout the Group as a director of the Company. He contributes to the enhancement of the Company's corporate value by making decisions and providing supervision based on his insight and experience.

Miho Niunoya [Outside Director, Audit and Supervisory Committee Member]

As an attorney at law, Ms. Miho Niunoya has been involved in assisting companies to enter overseas markets and resolving international disputes, and has provided legal support for real estate and energy businesses, etc. She has long been active mainly in the field of corporate legal affairs and has a wealth of insight and experience, and she contributes to enhancing our corporate value by making decisions and providing supervision based on such insight and experience.

Takashi Nagasaka [Outside Director, Audit and Supervisory Committee Member]

Mr. Takashi Nagasaka has acquired expertise and rich experience in corporate accounting while working as a certified public accountant at an audit corporation and boasts a record of accomplishment in serving as manager of the audit department and managing director, and has also served as an outside director of other companies. He will be able to offer useful advice based on his knowledge and experience, and improve the auditing function of the Company’s business executions.

Skills Matrix

The skills matrix for directors and executive officers is as follows (as of Aug 1, 2025).

Board of Directors

| Name Position |

Koichi Nishikawa President and Representative Director, CEO |

Norifumi Kawakami Director, Senior Executive Corporate Officer, CIO |

Takao Miki Director, Executive Corporate Officer, CFO |

Yoshimitsu Oura Outside and Independent Director |

Shoko Kuroki Outside and Independent Director |

|---|---|---|---|---|---|

| Corporate management | 〇 | 〇 | 〇 | 〇 | |

| Global business | 〇 | 〇 | 〇 | ||

| Accounting/Finance | 〇 | 〇 | 〇 | ||

| Legal affairs/Compliance | |||||

| Information systems/Technology | 〇 | 〇 | |||

| Human resources development/DEI | 〇 | ||||

| Sustainability | 〇 | 〇 |

| Name Position |

Shingo Yamanaka Director and Audit and Supervisory Committee Member |

Miho Niunoya Independent Outside Director, Audit and Supervisory Committee Member |

Takashi Nagasaka Independent Outside Director, Audit and Supervisory Committee Member |

|---|---|---|---|

| Corporate management | 〇 | ||

| Global business | |||

| Accounting/Finance | 〇 | ||

| Legal affairs/Compliance | 〇 | 〇 | |

| Information systems/Technology | |||

| Human resources development/DEI | |||

| Sustainability | 〇 |

Corporate Officers

| Name Position |

Kenichi Sasaki Senior Executive Corporate Officer, CHRO |

Keisuke Kawasaki Executive Corporate Officer, CLO and CCO |

Eichi Watanabe Senior Corporate Officer |

Yoichi Mitsunaka Corporate Officer |

Yasuji Iwabuchi Corporate Officer |

|---|---|---|---|---|---|

| Corporate management | 〇 | 〇 | |||

| Sales/Marketing | 〇 | ||||

| Global business | |||||

| Accounting/Finance | 〇 | 〇 | |||

| Legal affairs/Compliance | 〇 | ||||

| Information systems/Technology | 〇 | 〇 | |||

| Human resources development/DEI | 〇 | 〇 | |||

| Sustainability | 〇 |

| Name Position |

Shunro Uchimura Corporate Officers |

Makoto Odawara Corporate Officers |

Masaki Sato Corporate Officers |

|---|---|---|---|

| Corporate management | |||

| Sales/Marketing | 〇 | ||

| Global business | |||

| Accounting/Finance | 〇 | ||

| Legal affairs/Compliance | 〇 | ||

| Information systems/Technology | |||

| Human resources development/DEI | |||

| Sustainability |

Activity Report

Outline of the operations of the Board of Directors

The role of the Board of Directors of our company, which is a holding company, is to set management policy and targets for the Group as a whole and to supervise the execution of business in each Group company.

The Board of Directors meets once a month, in principle, or whenever necessary. In the fiscal year ended October 2024, 14 meetings were held. The rate of attendance was 100% for all directors.

In the fiscal year ended October 2024, Parking Business International, which has been on a recovery path in certain areas following the COVID-19 pandemic, continued to be reported as individual agenda items. This led to a more elaborate understanding of the situation and high-quality, lively discussions. In addition, outside directors’ visits to overseas sites promoted a better understanding of the business.

With regard to human capital management, measures linked to the Group’s management strategy were formulated and promoted.

Main issues considered by the Board of Directors

- Management Policy and Business Planning

- Capital Policy

- Compliance with TCFD framework

- Sustainability (human capital disclosure, etc.)

- Corporate governance (selection of directors and officers, determination of executive compensation, evaluation of board effectiveness, etc.)

Outline of the operations of the Audit and Supervisory Committee

The Audit and Supervisory Committee formulates the audit policy and plan as the basis for activities in collaboration with the departments responsible for internal control. Committee members attend important meetings and audit the legality and appropriateness of the execution of duties by directors by examining the Company’s operations and financial position. In the fiscal year ended October 2024 the Audit and Supervisory Committee met 15 times, with a 100% attendance rate for all members.

Main issues considered by the Audit and Supervisory Committee

- Audit policy and audit plan

- Development and administration of internal control systems

- Audit plans and methods of the accounting auditors, and audit results

- Assessment of and compensation for the accounting auditors

Outline of the operations of the Nomination, Compensation & Governance Committee

The Nomination, Compensation & Governance Committee ensures that outside directors are appropriately provided with opportunities to participate in deliberations and offer advice regarding the nomination and compensation of directors. The committee also works to enhance the fairness, transparency, and objectivity of the Board’s decision-making processes.

In the fiscal year ended October 2024, the committee met 12 times, with a 100% attendance rate for all committee members.

During the same fiscal year, the committee held multiple deliberations on director appointments, the evaluation and design of the executive compensation system, and the succession planning for future leadership.

Regarding the succession plan, the committee recognizes that nurturing the next generation of the management team, including the President, is an important task for increasing corporate value and fulfilling our corporate responsibility in the medium to long term. The committee has so far specified three qualities required of the Group’s management team (representative directors, directors, and corporate officers): honesty (dealing with people and situations with sincerity and commitment based on the good of society as a whole and the Company rather than personal gain); clear vision (presenting a profile for the Group’s future); and pioneering spirit (taking on new challenges and opening up new horizons). We will develop a succession policy and plan around these requirements.

Main issues considered by the Nomination, Compensation & Governance Committee

- Appointment of directors

- Executive compensation

- Evaluation indicators for incentives

- Skills matrix

- Succession plans

- Organizational structure and key personnel appointments for the fiscal year ending October 2025

Attendance of Directors at Board of Directors/Audit and Supervisory Committee during FY2024

Attendance of Directors at Board of Directors/Audit and Supervisory Committee is as follows(as of October 31, 2024).

| Director | Outside | Board of Directors (14 meetings) | Audit and Supervisory Committee (15 meetings) | ||

|---|---|---|---|---|---|

| Attendance | Rate | Attendance | Rate | ||

| Koichi Nishikawa | - | 14 | 100% | - | - |

| Kenichi Sasaki | - | 14 | 100% | - | - |

| Norifumi Kawakami | - | 14 | 100% | - | - |

| Keisuke Kawasaki | - | 14 | 100% | - | - |

| Yoshimitsu Oura | 〇 | 14 | 100% | - | - |

| Akiko Kuroki | 〇 | 14 | 100% | - | - |

| Shingo Yamanaka (Audit & Supervisory Committee Member) | - | 14 | 100% | 15 | 100% |

| Miho Nibutani (Audit & Supervisory Committee Member) | 〇 | 14 | 100% | 15 | 100% |

| Takashi Nagasaka (Audit & Supervisory Committee Member) | Yes | 14 | 100% | 15 | 100% |

* In addition to the above number of Board of Directors meetings, written reports were submitted twice in accordance with the provisions of Article 372, Paragraph 1 of the Companies Act.

Compensation for Officers

Design of compensation system (excluding directors and outside directors who are Audit and Supervisory Committee members)

1. Basic compensation system

Basic compensation is determined based on a compensation table that takes into account the director’s duties, roles, responsibilities, and the scale of business profit, among other factors.

2. Short-term incentive(STI)

Short-term incentive (STI) is calculated by multiplying the base amount set for each position by a factor corresponding to the achievement rate of evaluation indicators—namely, consolidated operating profit and consolidated net income. Consolidated operating profit is used as an indicator because it reflects profit from core business operations, unaffected by exchange rates or interest rates, and is therefore suitable for evaluating contributions to core business performance. Consolidated net income is selected as it directly reflects final profit and is thus appropriate for evaluating contributions to shareholder value. In addition to these quantitative indicators, qualitative indicators are also used to assess directors’ performance based on their respective roles.

3. Long-term incentive(LTI)

For long-term incentive (LTI), we have introduced a restricted stock compensation system. The restriction period is set to last until immediately after retirement from a position predetermined by the Board of Directors among those held at the Company or its subsidiaries. Given the nature of LTI as a reward for efforts to enhance long-term corporate value, the evaluation indicators include not only contributions to overall corporate profit—such as consolidated operating profit and consolidated net income—but also capital efficiency (ROIC), ESG indicators, and qualitative assessments. The ESG indicators are structured from the perspectives of environment, society, and governance. From an environmental standpoint, the degree of achievement of medium- to long-term sustainability targets is evaluated. In terms of social factors, the employee engagement index is used to assess organizational health and workforce motivation. For governance, the evaluation is based on ESG-related scores provided by external rating agencies.

Main requirements of the policy for determining individual compensation and other benefits

The policy is formulated based on the following four basic principles:

- Must serve as a motivation for sustainable improvement in business performance and enhancement of corporate value.

- Must contribute to securing highly capable executive talent.

- Must align interests with shareholders and promote a shareholder-focused management mindset.

- Must be highly linked to company performance, with a high degree of transparency and objectivity.

Method for determining the policy on individual compensation and other benefits

Based on consultation with the Board of Directors, the Nomination and Compensation Committee submits reports to the Board of Directors, who then sets the policy determining the details of individual compensation for directors.

Remuneration paid

Performance of Consolidated Operating Profit

| FY2023 | FY2023 | |

|---|---|---|

| Consolidated operating profit | 31,986 billion yen | 38,697 billion yen |

| YoY (Previous Consolidated FY) | 154.7% | 121.0% |

| Business Plan (Consolidated Operating Profit) | 27,000 billion yen | 35,000 billion yen |

| Achievement Rate (Cons. Op. Profit Plan) | 118.5% | 110.6% |

Performance of Consolidated Net Income

| FY2023 October |

FY2024 October |

|

|---|---|---|

| Net Income Attributable to Owners of Parent | 17,542 million yen | 18,625 million yen |

| YoY (Prev. Cons. FY) | 708.2% | 106.2% |

| Business Plan (Consolidated Operating Profit) | 13,000 million yen | 20,000 million yen |

| Achievement Rate (Cons. Op. Profit Plan) | 134.9% | 93.1% |

Total compensation by category of director and category of compensation, as well as the number of directors in each category

| Position | Total Compensation (Million Yen) | Breakdown by Type (Million Yen) | Number of Officers | ||

|---|---|---|---|---|---|

| Base Compensation | Performance-Based Compensation | ||||

| Short-Term Incentive (STI) | Long-Term Incentive (LTI) | ||||

| Directors (Excl. Audit & Supervisory Committee Members and Outside Directors) |

331 |

161 |

116 |

54 |

6 |

| Directors (Audit & Supervisory Committee Members, Excl. Outside Directors) |

25 |

25 |

- |

- |

2 |

| Outside Directors |

47 |

47 |

- |

- |

4 |

※Disclosure of individual officer compensation amounts has been omitted, as no officer received compensation of 100 million yen or more.

Evaluating the Effectiveness of the Board of Directors

Our company conducts an annual evaluation of the effectiveness of the Board of Directors. Specifically, we administer a questionnaire to all directors every fiscal year, and once every three years, we receive advice from an external organization and conduct individual interviews with all directors. The results are collated and analyzed before being reported to the Board of Directors, which checks progress on responses to issues identified in the previous fiscal year and formulates new policies to address any issues identified in the current fiscal year. The purpose of these effectiveness evaluations of the Board of Directors is to continuously strengthen our corporate governance through the formulation and implementation of specific measures.

Support System for Outside Directors

A support system is in place to ensure that outside directors can fully fulfill their roles and responsibilities. At Board of Directors meetings, materials for agenda items are sent out at least two business days prior to the meeting, and advance explanations are provided at least one business day prior to the meeting. This enables us to provide a wide range of internal information, including a summary of the issues for each agenda item, to make effective use of the Board of Directors' deliberation time and to engage in constructive discussions. In addition to providing opportunities for outside directors to gain an in-depth understanding of our business, we regularly hold "Director Training" sessions to give directors, including outside directors, the chance to fully understand the latest information on sustainability, corporate governance, and internal controls.

Status of Other Corporate Governance

Matters to be resolved at the shareholders meeting that can be resolved at a meeting of the Board of Directors

(a) Acquisition of treasury stock

The Articles of Incorporation of Park24 stipulate that the Company may acquire its own shares in market and other transactions by resolution of a meeting of the Board of Directors, in accordance with the provision of Article 165, Paragraph 2 of the Companies Act, for the purpose of operating a flexible capital policy for its shareholders.

(b) Interim dividends

The Articles of Incorporation also stipulate that the Company may pay interim dividends with April 30 every year as the record date by resolution of a meeting of the Board of Directors for the purpose of executing a flexible dividend policy.

Number of Directors

The Articles of Incorporation stipulate that the Company shall have no more than ten Directors (excluding Directors who are Audit and Supervisory Committee Members), and that it shall have no more than five Directors who are Audit and Supervisory Committee Members.

Requirements for Resolutions for the Election of Directors

The Articles of Incorporation stipulate that the resolution to elect Directors shall be made by a majority of the eligible votes of shareholders present at a shareholders’ meeting, where shareholders holding at least one-third or more of the votes with voting rights are present. The Articles of Incorporation also stipulate that resolutions to elect directors shall not be by cumulative voting.

Agreements Limiting Liability

The Articles of Incorporation of Park24 stipulate that, pursuant to Article 427, Paragraph 1 of the Companies Act, the Company may enter into agreements with non-Executive Directors to limit their liability. In accordance with these provisions, the Company has entered into agreements with three Directors who are Audit and Supervisory Committee Members and two Outside Directors who is not an Audit and Supervisory Committee Member, limiting their liability under Article 423, Paragraph 1 of the Companies Act, and the maximum amount of the compensation for damage under such agreement shall be the minimum liability amount stipulated in Article 425, Paragraph 1 of the Companies Act.